adversiment

Today, knowing about APR, or Annual Percentage Rate, is key for credit card users. This rate impacts how much you pay for credit. It also affects the total cost of borrowing. Understanding APR helps you make smart choices. This can prevent high interest costs and deep debt.

This piece will clarify APR by breaking down its parts and effects. You’ll see how knowing APR helps you control your money better.

What is APR?

APR, or Annual Percentage Rate, is a big deal in money matters. It shows the yearly cost to borrow money. What is APR about? It’s a way to measure borrowing costs that helps people compare different loans or credits easily.

The definition of annual percentage rate includes interest and other charges. So, APR gives a complete picture of what you’ll pay, not just the basic interest. This comprehensive view helps you see the full cost of a loan.

Understanding APR in credit cards is super important. Credit cards might offer low rates at first that go up later. Knowing the APR helps you manage your money better. This way, you can avoid big interest charges in the future.

Importance of Understanding APR

Understanding APR is key for anyone using credit cards or loans. It affects your monthly payments and the interest you’ll pay. Knowing about APR helps with smarter loan choices to meet your financial goals.

Interest rates play a big role in finances. A high APR means paying more, a low one means saving money. Digging into your credit card’s APR details can reveal how it impacts your money over time. It’s vital for managing your budget and debts well.

Learning about APR helps you avoid financial traps. Knowledge lets you steer clear of costly mistakes. This understanding is crucial.

Components of APR

Understanding APR’s components is key to smart financial choices. The Annual Percentage Rate (APR) includes several parts. Most notably, it comprises interest rates, finance charges, and sometimes hidden fees. Each part affects how much you’ll pay when you borrow money.

Interest Rates Explained

Interest rates are crucial in APR. Lenders look at your financial health to set these rates. Your credit score, how you’ve handled past payments, and your current financial status matter. They decide the interest rate you’ll get. If your rate is higher, you’ll pay more over the loan’s life. This is why two people might get different rates for the same loan product.

Finance Charges and Other Fees

Finance charges are extra fees that increase borrowing costs. These can include yearly fees, fees for late payments, and more. Such costs can make the APR higher than just the interest rate suggests. Knowing about these fees helps avoid surprises. It also helps you pick the better financial options.

| Component | Description | Impact on APR |

|---|---|---|

| Interest Rates | Percentage charged on borrowed funds. | Directly affects the cost of borrowing. |

| Finance Charges | Fees for borrowing, including servicing fees. | Increases total repayment amount. |

| Hidden Fees | Unforeseen charges, often found in fine print. | Can significantly raise APR. |

Understanding APR: How It Affects Your Borrowing Costs

The Annual Percentage Rate (APR) is crucial in the world of finance. It especially impacts how much you pay for credit card debt. Knowing about APR helps you make smarter money choices.

A higher APR means you’ll pay more over time. It’s key to choose credit options with this in mind. Let’s compare two credit cards. One has an APR of 20% and another 15%. This difference can greatly add to your purchase costs.

| APR Rate | Total Amount Paid | Interest Charged |

|---|---|---|

| 15% | $1,226.80 | $226.80 |

| 20% | $1,331.60 | $331.60 |

This table clearly shows how APRs impact your costs. It’s important to think about APR when dealing with credit card debt. Understanding APR helps you pick the best options and reduce financial stress.

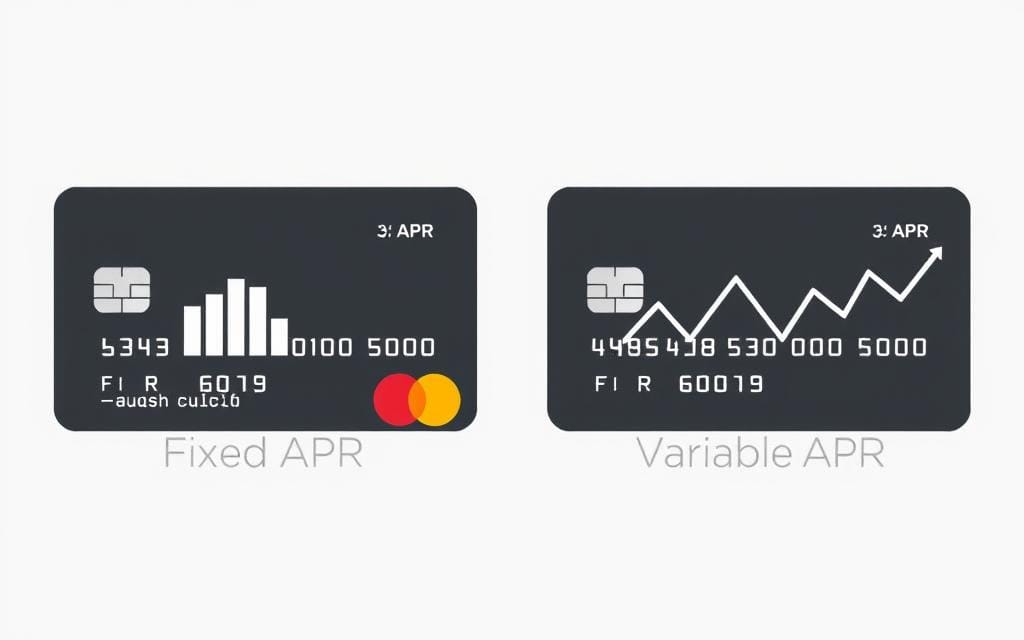

Fixed vs. Variable APR

Knowing how fixed APR and variable APR differ is key when choosing a credit card. Each kind has its pros and cons that affect your money.

Pros and Cons of Fixed APR

Fixed APR makes budgeting easier, with stable monthly payments. You know what the interest rate will be, which helps plan costs. But, fixed APRs usually start higher than variable ones.

- Advantages:

- Predictable monthly payments

- Protection from changing interest rates

- Disadvantages:

- Initial rates are higher

- Less benefit if market rates go down

Understanding Variable APR

Variable APR can change with the economy, affecting market interest rates. Sometimes, you might get lower rates, saving money. Yet, you have to watch out for rate hikes.

- Advantages:

- Chance of lower rates when the market is good

- Adjusts with the economic climate

- Disadvantages:

- Monthly payments can be unpredictable

- Costs may rise if market rates do

| Feature | Fixed APR | Variable APR |

|---|---|---|

| Stability of Payments | High | Low |

| Risk of Rate Changes | None | Present |

| Typical Interest Rate | Higher | Lower |

| Budgeting Ease | Easy | Challenging |

Calculating APR

Learning how to calculate APR is key for smart borrowing. Loan calculators make this easier. They help users understand and compare credit options well. Knowing about APR lets people handle their financial duties better.

Loan Calculators and Their Use

Loan calculators are essential for figuring out APR. These financial tools simplify loan costs. Enter the loan size, interest rate, and term to see your APR. This makes comparing loans simple.

Examples of APR Calculation

Looking at APR examples helps grasp its effect on loan costs. Consider this basic example:

| Loan Amount | Interest Rate | Loan Term | APR |

|---|---|---|---|

| $10,000 | 5% | 5 years | 5.2% |

| $20,000 | 7% | 3 years | 7.3% |

This table shows APR based on various loan features. By using calculators, you can make better financial decisions.

Impact of APR on Credit Cards

Understanding the credit card APR impact is crucial, especially when comparing cards with high and low rates. It helps cardholders make wise choices. Cards with high interest can quickly grow debt, making it tough to keep up with payments.

When using credit cards, people often face different situations. These situations show why it’s important to look at APRs before buying. Here’s a look at how APR can change the total cost over time between two credit cards.

| Credit Card | APR (%) | Balance ($) | Interest after 1 Year ($) |

|---|---|---|---|

| Card A (Low-Interest) | 12% | 1,000 | 120 |

| Card B (High-Interest) | 25% | 1,000 | 250 |

This example shows that APR can really change how much interest you pay in a year. Picking a credit card by its APR is key to managing credit costs. It helps avoid the trap of high interest and keeps your financial health and credit score good.

Missing a payment can make things worse, adding to why it’s smart to choose credit cards wisely. Knowing about the credit card APR impact helps you steer clear of debt from high-interest cards.

APR and Debt Management

Managing your debt smartly means planning well to cut costs. This is crucial when dealing with Annual Percentage Rates (APR). By applying smart debt management tactics, you can save a lot. It’s especially true for methods that lower APR. Knowing how your credit score affects APR helps get better loan terms.

Strategies for Lowering APR

To lower your APR, try these steps:

- Negotiating with creditors: If you pay on time, many creditors might offer lower rates.

- Consolidating debt: Combining many debts into one loan could lead to a lower APR.

- Using balance transfer offers: Moving high-interest balances to cards with low APR deals helps temporarily.

- Regularly reviewing statements: Watching your rates helps you know when to adjust.

The Role of Credit Scores in APR

Your credit score is key in getting a good APR. High scores often mean lower rates. Knowing how credit scores and APR link is crucial for managing your debt well.

Here’s an example of how credit scores affect APR offers:

| Credit Score Range | Typical APR |

|---|---|

| 300-579 | 20% – 25% |

| 580-669 | 15% – 20% |

| 670-739 | 10% – 15% |

| 740-799 | 5% – 10% |

| 800+ | 3% – 5% |

Personal Budgeting and APR

Understanding APR is key in personal budgeting. It helps shape your financial health. Borrowers need to know how APR affects their budgeting.

It is crucial for planning your money every month. Knowing about APR lets people predict their expenses better. This leads to more effective financial planning.

- Assess current credit card balances and their respective APRs.

- Allocate a portion of your income specifically for paying down high-APR debts first.

- Consider consolidating debts to secure a lower overall APR.

- Regularly evaluate your budget to adjust for changes in APR.

Calculating interest rates is a must in budgeting. It shows how much they add to monthly payments. This helps in creating a budget that fits all expenses, including credit card payments.

Ignoring APR might cause budget issues. It can disrupt even the best financial plans.

Using smart budgeting strategies is important. These steps keep expenses under control. By focusing on APR, borrowers manage their credit card expenses better. This keeps them on track with financial goals.

| Credit Card | APR | Monthly Payment | Payoff Time (Months) |

|---|---|---|---|

| Chase Freedom | 15.99% | $100 | 6 |

| Capital One Quicksilver | 18.24% | $100 | 7 |

| Discover It | 19.99% | $100 | 8 |

| Citi Double Cash | 14.74% | $100 | 6 |

Understanding APR’s effect on budgeting helps borrowers. It improves their financial planning. They can take steps with confidence towards their financial goals.

Conclusion

As we finish our journey through APR, it’s clear that knowing this financial concept is key for cardholders. Learning about APR, including how different factors affect it, helps people use their credit wisely.

Thinking more about APR, it’s crucial to review financial products carefully. Knowing about fixed and variable APRs, and how to calculate them, makes people smarter with money. This knowledge helps avoid borrowing mistakes.

In the end, understanding APR is vital for managing finances. With this insight, cardholders can use credit more wisely. This leads to better financial health over time.

FAQ

What is the difference between APR and interest rate?

The Annual Percentage Rate (APR) considers both the interest and any fees. It shows the total cost of borrowing. The interest rate only shows the cost of using the borrowed money.

How can understanding APR help me manage my debt?

Knowing APR helps you choose wisely between loans. Loans with lower APRs mean you pay less over time. This smart choice helps manage your debt better.

Can my credit score affect the APR I receive?

Yes, your credit score influences the APR lenders offer. A higher score can get you a lower APR. This means you’ll pay less over the life of the loan.

What should I consider when choosing between fixed and variable APR?

For fixed APR, your payments stay the same. Variable APR can change, sometimes giving you lower rates. Think about what’s best for you.

How do I calculate APR on my loans?

Use online loan calculators to figure out APR. You’ll need to input your loan amount, interest paid, and any fees.

What are some strategies to lower my APR?

To get a lower APR, negotiate with creditors or consolidate loans. Also, improving your credit score by paying on time helps.

How does APR impact my personal budgeting?

APR affects how much you spend on borrowing. Including APR in your budget helps manage expenses and credit costs.

What happens if I miss a payment regarding APR?

Missing a payment may increase your APR and finance charges. Stay current to keep your APR low and avoid extra debt.

Is it possible to shop around for a better APR?

Definitely! Look for lower APRs to save on borrowing. Comparing different offers and using calculators aids in making informed decisions.